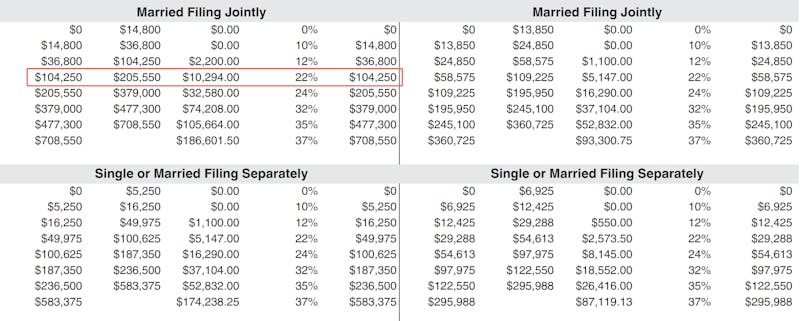

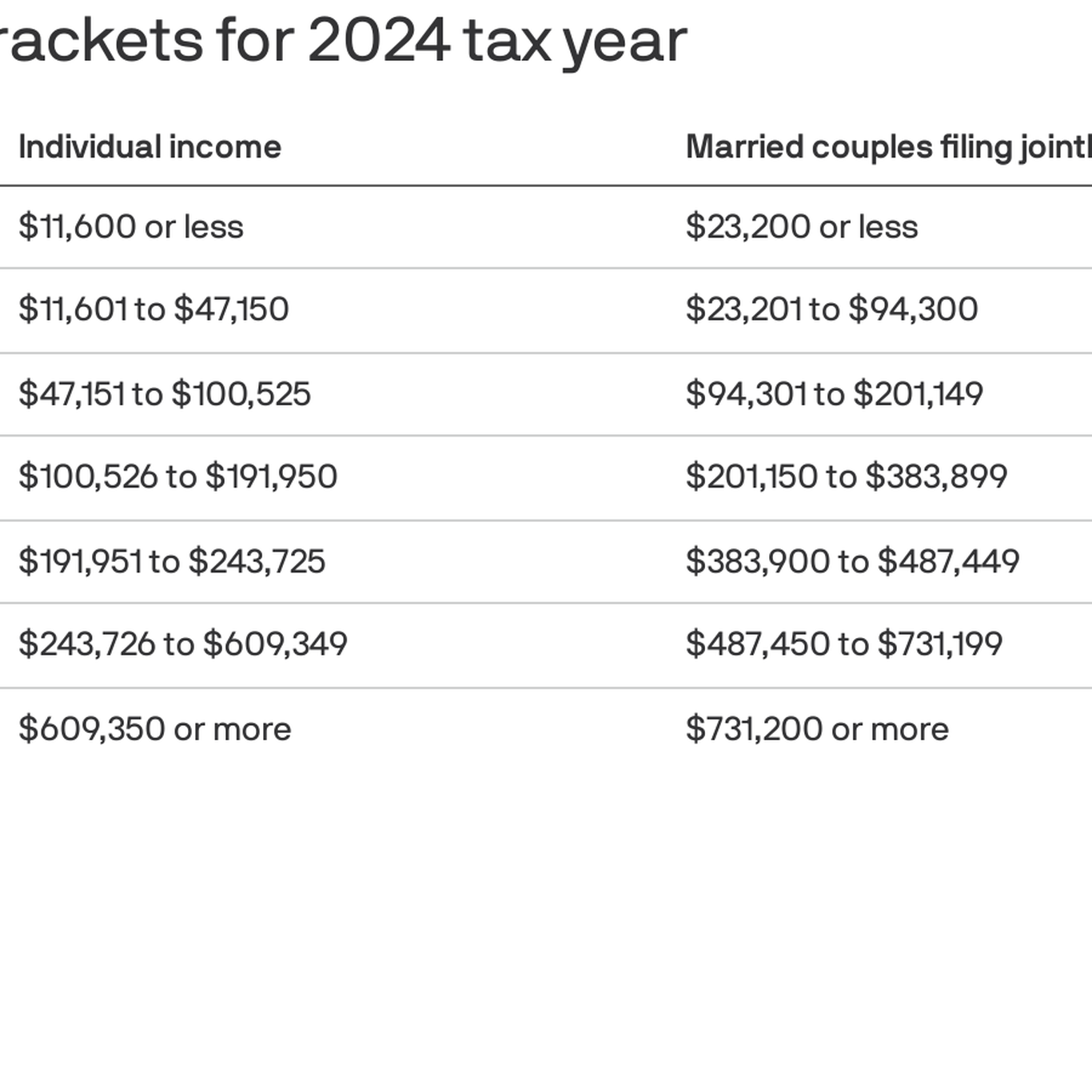

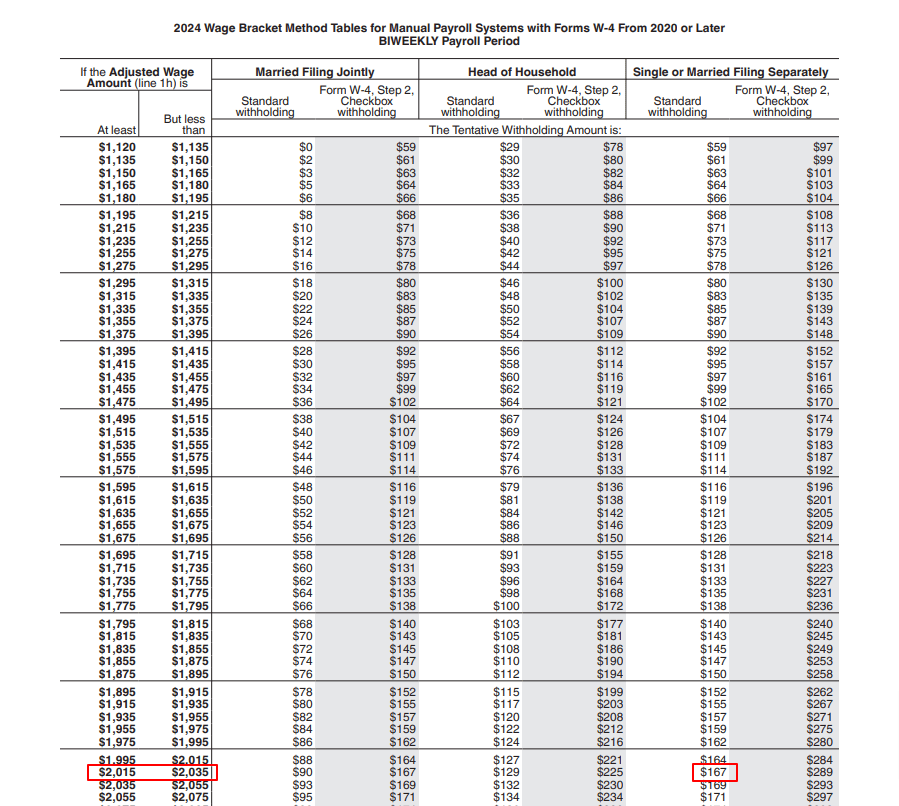

Federal Withholding Tables 2024 – Tax brackets are the government’s way of ensuring that taxpayers who earn more money pay more in taxes. Each bracket consists of a tax rate that’s applied to taxable income within a specific range. . Find out everything you need to know about 2024 tax brackets, from how they work to how they’ve changed and how they impact your tax liability. .

Federal Withholding Tables 2024

Source : www.forbes.com2024 Income Tax Brackets And The New Ideal Income Financial Samurai

Source : www.financialsamurai.comHow To Calculate Your Federal Taxes By Hand · PaycheckCity

Source : www.paycheckcity.com2024 tax brackets: IRS inflation adjustments to boost paychecks

Source : www.axios.comIRS: Here are the new income tax brackets for 2024

Source : www.cnbc.comUpdated Income Tax Withholding Tables for 2024: A Guide

Source : www.patriotsoftware.comIRS Tax Brackets 2024, Federal Income Tax Tables, Inflation Adjustment

Source : www.nalandaopenuniversity.comFederal Income Tax Brackets For 2024

Source : thecollegeinvestor.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comKick Start Your Tax Planning For 2024

Source : www.benefitandfinancial.comFederal Withholding Tables 2024 Your First Look At 2024 Tax Rates: Projected Brackets, Standard : If you earn income that isn’t subject to federal tax withholding – such as from you must withdraw is based on the life expectancy table for your age and the balance in your account by . At the end of the year, any bonus you receive from an employer will be added to your wages, tips and other compensation. The total will be taxed according to the federal income tax rates that apply to .

]]>